There wasn’t always a standard formula for calculating future lost wages when a plaintiff suffered a loss of enjoyment of life or hedonic damages. Before this methodology became standard practice in injury and wrongful death trials, economists faced an uphill battle to ensure fair settlements for plaintiffs in personal injury cases. This article is a look back to the past at how economists such as Stanley V. Smith used both logic and accurate statistical mathematics to overcome an unfair ruling that had a significant impact upon the interpretation of language, and ultimately, how future lost wage estimates would be calculated in injury and wrongful death cases.

This article originally appeared in: Chicago Daily Law Bulletin, Wednesday June 8, 1988

By Stanley V. Smith

In American National Bank v. Thompson, 158 Ill.App.3d 478, 511 N.E.2d 1206 (1987), Justice William R. Quinlan interprets the Illinois Jury Patten Instruction Civil 2d No. 34.05 definition of “present cash value of future wages” to mean that inflation and real wage growth may not be taken into account, but that the wage stream must be discounted.

It seems that IPI 34.01 through 34.04 are similarly affected. Most economists would agree that this constitutes a bias against plaintiffs and is bad legal economics (although not necessarily Justice Quinlan’s fault).

Fortunately, the effects can be substantially mitigated.

In two recent articles published by the Law Bulletin (“Showcasing the economics experts in big cases,” Lawyer’s Forum, April 26, 1988, by Terrence J. Lavin, and a reply on May 6 by C. Barry Montgomery), the authors debate the merits of the IPI instruction and its interpretation.

Lavin argues that the limitation is contrary to a majority of jurisdictions and to the methodology affirmed by the U.S. Supreme Court in Jones & Laughlin Steel Corp v. Pfeifer, 462 U.S. 523 (1983), in which inflation and the real growth of wages are specifically taken into account.

Without commenting on its fairness, Montgomery defends the ruling as a proper exercise of the court’s discretion and asserts that Illinois has never approved the admissibility of inflationary trends or projected growth of real earnings.

Justice Buckley’s dissent in ANB v. Thompson points out that the majority opinion assumes a world of zero inflation, that a slavish adherence to the instruction results in bestowing a windfall on the negligent tortfeasor at the expense of the plaintiff, and that denying the effects of inflation is completely out of touch with economic reality.

The Illinois Supreme Court has denied an appeal. The effects, however, can and should be greatly minimized by a proper interpretation of the ruling.

Inflation’s Significant Role in Calculating Future Lost Wages Due to Loss of Enjoyment of Life

In mid-May in the Circuit Court of Cook County, I testified as to lost wages in Ives v. National Railroad, No. 85 L 25786. As an economist, I would ordinarily view the calculation of lost future wages as a straightforward conceptual exercise.

But the language of the IPI instruction, coupled with Justice Quinlan’s interpretation, has created a serious limitation that calls for closer analysis.

It seems that a proper application of the law would require that an economist arrive at an opinion of the present value which would be as little as 50 percent of what I believe to be an economically fair and unbiased estimate. After a closer look, however, I was able to arrive at a method which preserved 90 percent of an economically fair estimate.

How could that be done?

The IPI code states: “Present cash value means the sum of money needed now, which, together with what that sum will earn in the future, will equal the amounts of the pecuniary benefits at the times in the future when they would have been received.”

Justice Quinlan wrote: “… This instruction does not suggest any requirement that inflation and growth of real earnings be included in the determination…” and that “… the definition of present cash value employed by the plaintiff’s expert, which included inflation and growth of real earnings as well as interest earnings, is not in accordance…” with the IPI instruction and relevant case law.

Thus far, however the concern has focused entirely on the numerator of future wage estimates, namely the factors for inflation and wage growth. Customarily, the future wage estimate equals current wages, times inflation, times real wage growth, all divided by the discount rate. For now, inflation and real growth in wages cannot be taken into account.

But we must also consider the ruling’s implications for the denominator; the discount rate by which future wages estimates are reduced to present cash value. Here is where the ruling’s main limitation on the numerator can be corrected and according to a strict interpretation of the code and the opinion, must be.

Customarily, after projecting increases for inflation and real growth, wages are discounted using “nominal” interest rates projections which for U.S. Treasury Bills is between 7 percent and 8 percent. A projection of “real” rates, defined as the expected nominal interest rate minus the expected inflation rate of (of about 7 percent), is approximately 1 percent. Given the ruling, this 1 percent real rate should be the discount rate.

Why use real rates?

Because only they conform to the opinion by specifically not taking inflation into account. The real rate of interest is what is earned in a world where inflation is not included. If the opinion states that inflation cannot be included in calculating present value, then one cannot use nominal interest rales which do include compensation for expected inflation. A strict interpretation of the code and the opinion mandates that real rates be used.

Using Real Rates vs. Nominal Rates on Calculating Future Lost Wages Accurately

Using real rates is in accord with the IPI instruction even though the present lump sum will earn at the rate of nominal interest. The instruction states that nominal interest earnings must be taken into account. These earnings together with the original principal, determined by using real rates, will “equal the amounts of the pecuniary benefits at the times in the future when they would have been received,” as the code requires, irrespective of what future inflation turns out to be.

There is no requirement, however, that the nominal interest rate earned — which includes compensation for inflation — be actual discount rate. In fact, it can’t be the discount rate since it takes inflation into account. Only the real rate conforms to the code and the ruling.

By using real rates to discount a constant wage projection, the effects of future inflation are entirely removed from both the numerator and the denominator.

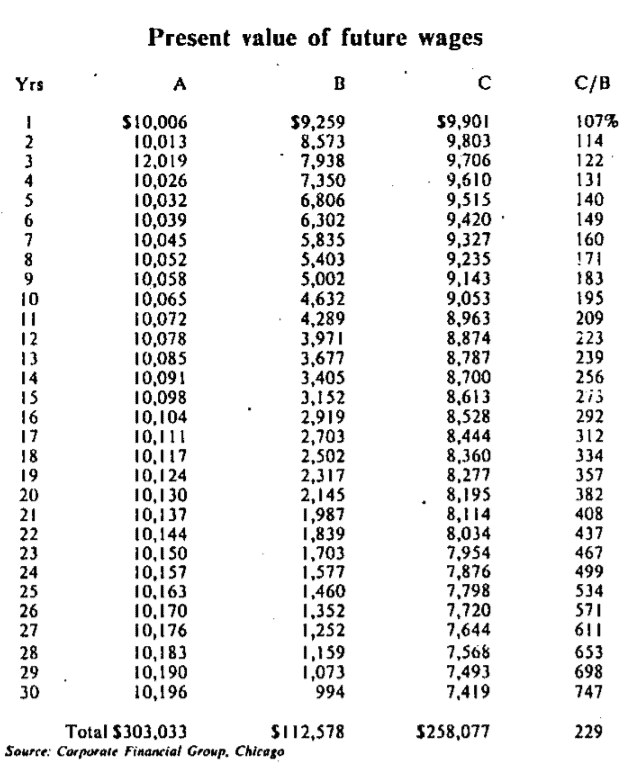

The accompanying table shows the effect of three methods of estimating the present value of future wages given a current $10,000 annual wage. Method A shows what wages an economist might predict for any future year, assuming 7 percent inflation, 8 percent nominal short-term rates and a 1 percent real wage growth rate.

Wages in the nth year in the future equals $10,000 x (1.07)n x (1.01)n divided by (1.08)n. (The compounding effects of 7 percent times 1 percent, discounted by 8 percent produce a slight growth in wages.)

Method B shows the effects not using inflation or real growth, but incorrectly using an 8 percent nominal interest rate which includes an inflation component. This is the method thought to be in compliance with the instruction and used in ANB v. Thompson. After 30 years, the present value of wages has fallen to 10 cents on the dollar.

Method C shows the effects of not using inflation or real growth, but correctly using a 1 percent real interest rate which has no inflation component. After 30 years, the present value falls to 74 cents on the dollar.

Column D (column C divided by column B) shows the strength of using real rates versus nominal rates. In the 30th year, real rates provide over 7 times the wage preservation. In total over 30 years, using real rates provides 2.3 times as much wage value.

The significance of Ives v. National Railroad in the Circuit Court is that the attorney for the plaintiff, Nicholas J. Motherway, successfully argued that the real interest rate was in conformity with the IPI code and Justice Quinlan’s opinion, and my testimony was admitted into evidence by Judge Cawley. While the words “inflation” and “real growth in wages” were never mentioned to the jury, nominal rates were not used.

The injured plaintiff, who had a remaining work life of about 12 years, earned approximately $24,000 plus fringes at her former occupation. The jury returned a verdict of $200,000 for lost earnings, after taking into account testimony about future employability. This award is perhaps double what might have otherwise been awarded had nominal rates been used. Furthermore, it is much closer to economic fairness.

To the extent that this methodology is upheld in Illinois, the prospect for the bestowal of a windfall to the negligent tortfeasor due to ANB v. Thompson will be greatly diminished. And most important, the rights to an economically fair recovery by prospective future victims will be greatly restored.

Nonetheless, the IPI instruction should be amended in the future so that prospective real wage growth can also be taken into account. Also, while IPI 34.01 states that “a person’s earnings may remain the same or may increase or decrease in the future, further clarity is needed regarding whether this means increases to advancement in job grade.

The assistance of an economist in the drafting of IPI amendments could eliminate present ambiguity and help insure that economic rights of all citizens are protected so that future court interpretations support the integrity of these rights.

Table 1